Comparative Market Analysis aka CMA: What It Is and What It Isn’t

A Comparative Market Analysis, aka CMA, determines the fair market value of a home. You may also hear them referred to as “comps”. If you’re new in the housing market, we’ve got a quick and easy explanation for what CMAs are, what they aren’t, and how they’re completed.

What is a CMA?

When a seller is ready to list their home for sale, the Realtor® needs to determine fair market value for the home. They create a pricing estimate based on specific factors that compare the home to other homes. It’s important to understand that this estimate, while based on a lot of factors, is not a guarantee that the home will find a buyer at that list price. Sellers should always discuss how the CMA was created and be prepared for their Realtor to negotiate the best possible deal. Realtors are the local market experts in part because of their ability to create a Comparative Market Analysis report.

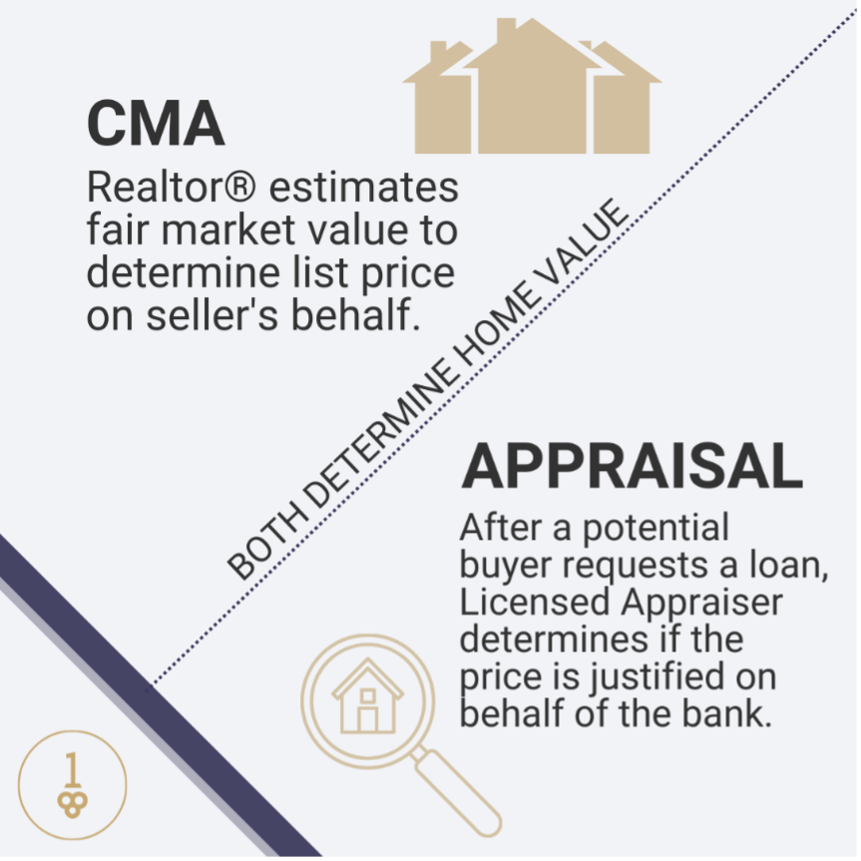

Is a CMA an Appraisal?

NO. A CMA is completed by a Realtor to estimate the fair market value of a home and determine a list price on the seller’s behalf. An Appraisal is completed by a Licensed Appraiser. After a potential buyer requests a loan to purchase the home, the lending bank enlists a Licensed Appraiser to determine if the asking price is justified. The Appraiser acts independently to draw this conclusion based on a variety of factors and the bank will only authorize the buyer to borrow funding based on the value of the home. Read more about Home Appraisals by clicking here.

How is a CMA created?

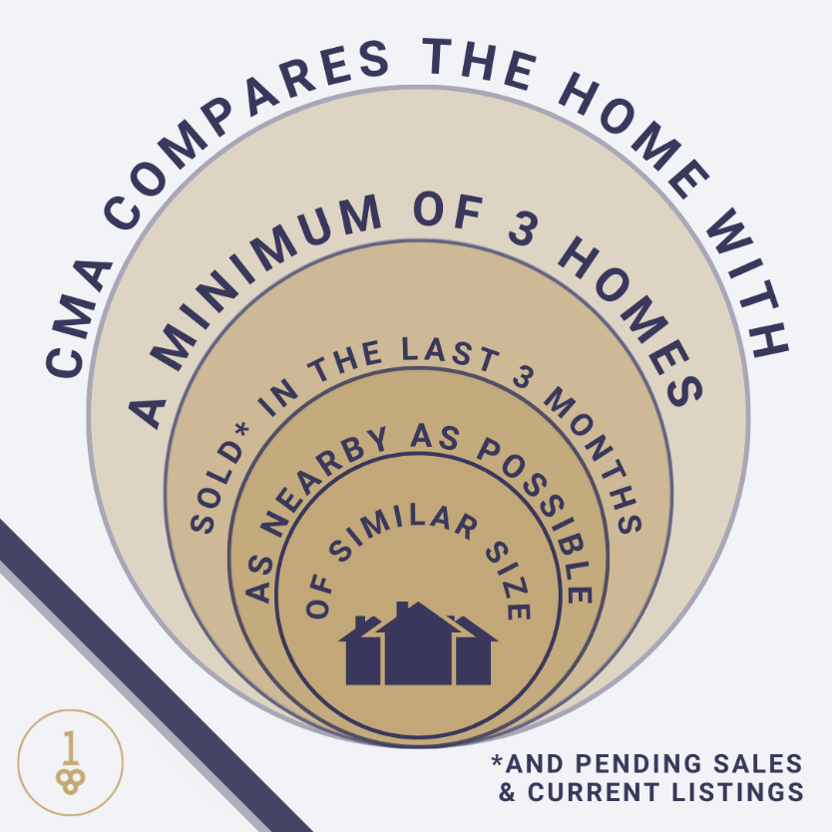

A Realtor will create a CMA by comparing the home with other homes. Typically, the Realtor will look at a minimum of three homes which have sold in the last three months in very close proximity to the house in question and of a similar size with similar features.

Some home features considered include location, the interior and exterior condition and any needed repairs, the year the home was built, the square footage, the size of the property or lot, the number of bedrooms and bathrooms, and any special features, like basements, garages, sheds, pools, etc. Keep in mind that not all home features have value in all local area markets. For example, having exterior cellar access may be highly desirable if you live in the mountains, but less so if you live in a flood zone.

Realtors also consider and compare pending sales and current listings nearby, as well as other local market conditions.

What is my home worth in today’s market?

If you want to know what your home is worth in today’s market, speak with a Realtor®. They can complete a Comparative Market Analysis and let you know approximately what you could expect if you decided to sell your home. Visit www.onekeymls.com/Directory and find a Realtor who will be your advocate and ally as you enter the real estate market.