Key Terms for Homebuyers Defined [INFOGRAPHIC]

If you have #homeownershipgoals for 2023, you’ll need to know some of these key terms for home buyers. Read through them, and then check out the infographic for more.

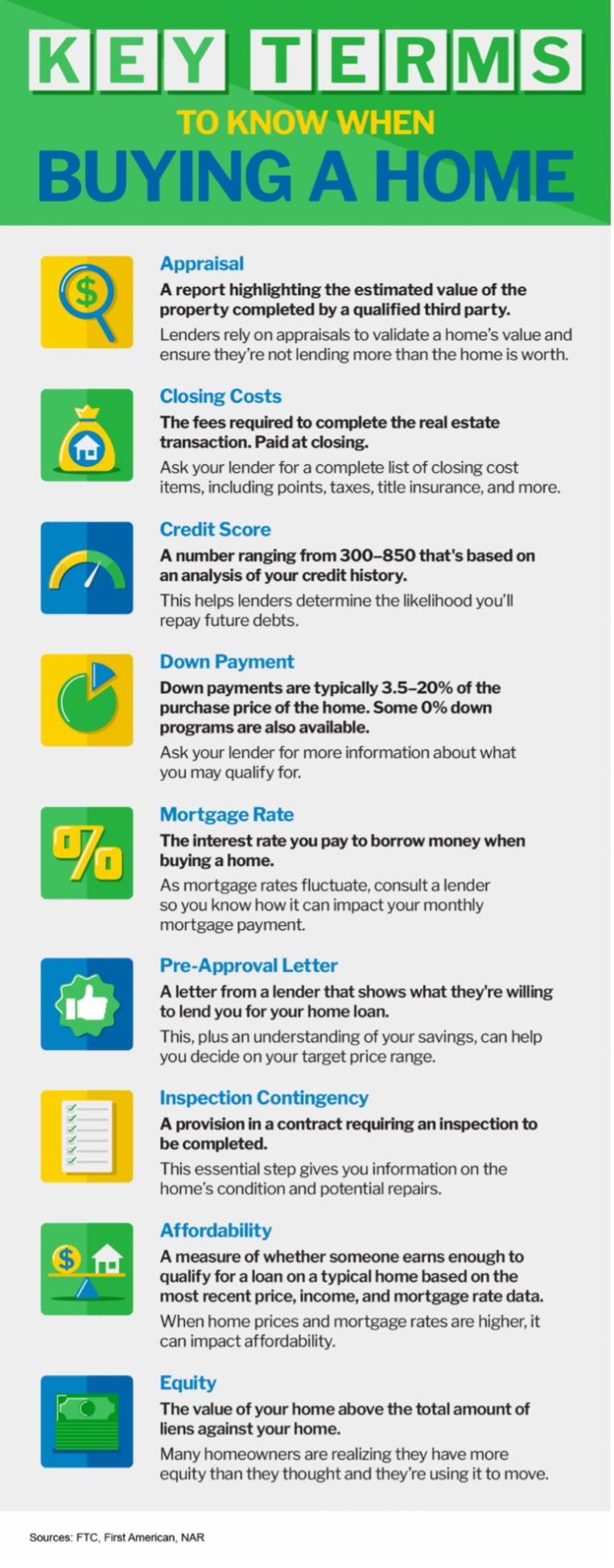

Appraisal

An appraisal is a report highlighting the estimated value of the property completed by a qualified third party.

Closing Costs

Closing costs are the fees required to complete the real estate transaction and they are paid at closing.

Credit Score

Your credit score is a number ranging from 300 to 850 that’s based on an analysis of your credit history.

Down Payment

A down payment is typically 3.5% to 20% of the purchase price of the home, but there are 0% down programs available as well.

Mortgage Rate

The mortgage rate is the interest rate you pay to borrow money when buying a home.

Pre-approval Letter

The pre-approval letter is from a lender and shows what the lender is willing to lend you for your home loan.

Inspection Contingency

The inspection contingency is a provision in a contract that requires an inspection to be completed.

Affordability

Affordability is the measure of whether someone earns enough to qualify for a loan on a typical home based on the most recent price, their income, and mortgage rate data.

Equity

Equity is the value of your home above the total amount of liens against your home.

Final Thoughts

Buying a home[1] is a major transaction that can seem even more complex when you don’t understand the terms used throughout the process.

If you’re looking to become a homeowner this year, it’s important to know these housing terms[2] and how they relate to the current housing market so you feel confident throughout the homebuying process.

Speak with a Realtor®, who will talk you through the process of buying a home and help make your dreams come true.