The Impact of Changing Mortgage Rates [INFOGRAPHIC]

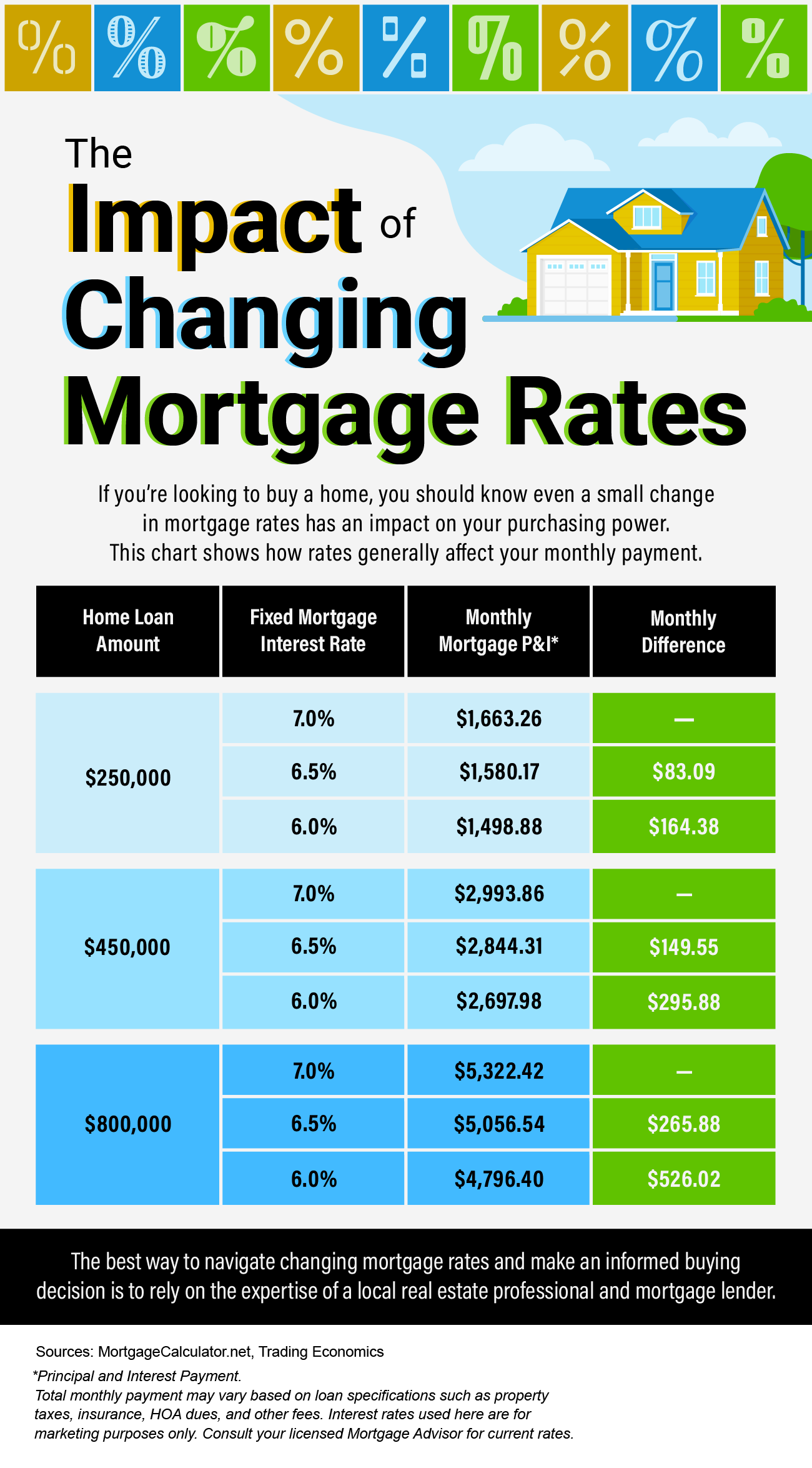

With so much talk about the housing market, as a buyer or a seller it’s important to understand how your goals might be impacted by changes in rates.

For example, a $450,000 home loan, with a fixed mortgage interest rate of 6.5% would require a principle and interest (P&I) payment of $2,844.31 per month. At a 7.0% fixed interest rate, the P&I adds an additional $149.55.*

See the infographic below.

*There are other factors that impact these numbers (e.g. taxes & insurance), which is why it’s important to rely on the professionals to help you make informed decisions. A Realtor® is your local real estate expert, staying informed of the changing market dynamics, and they can help you make sense of the housing market and all of the factors that go into a monthly payment.

Final Thoughts

If you’re in the market for a new home, know that even a small change in mortgage rates has an impact on your purchasing power.

- The Infographic above shows how rates generally affect your monthly payment, but are not meant to be taken as absolute.

- The best way to navigate the buying process is by relying on the trusted expertise of a Realtor® or a licensed mortgage advisor.

Recommended Post: Buyer Activity is Up Despite Higher Mortgage Rates

Adapted from Keeping Current Matters.