You DON’T Need 20% Down: Busting Myths about the Homebuying Journey

Most homebuyers do a significant amount of online research before contacting a mortgage lender or real estate agent. This is especially true for first-time homebuyers in need of down payment assistance.

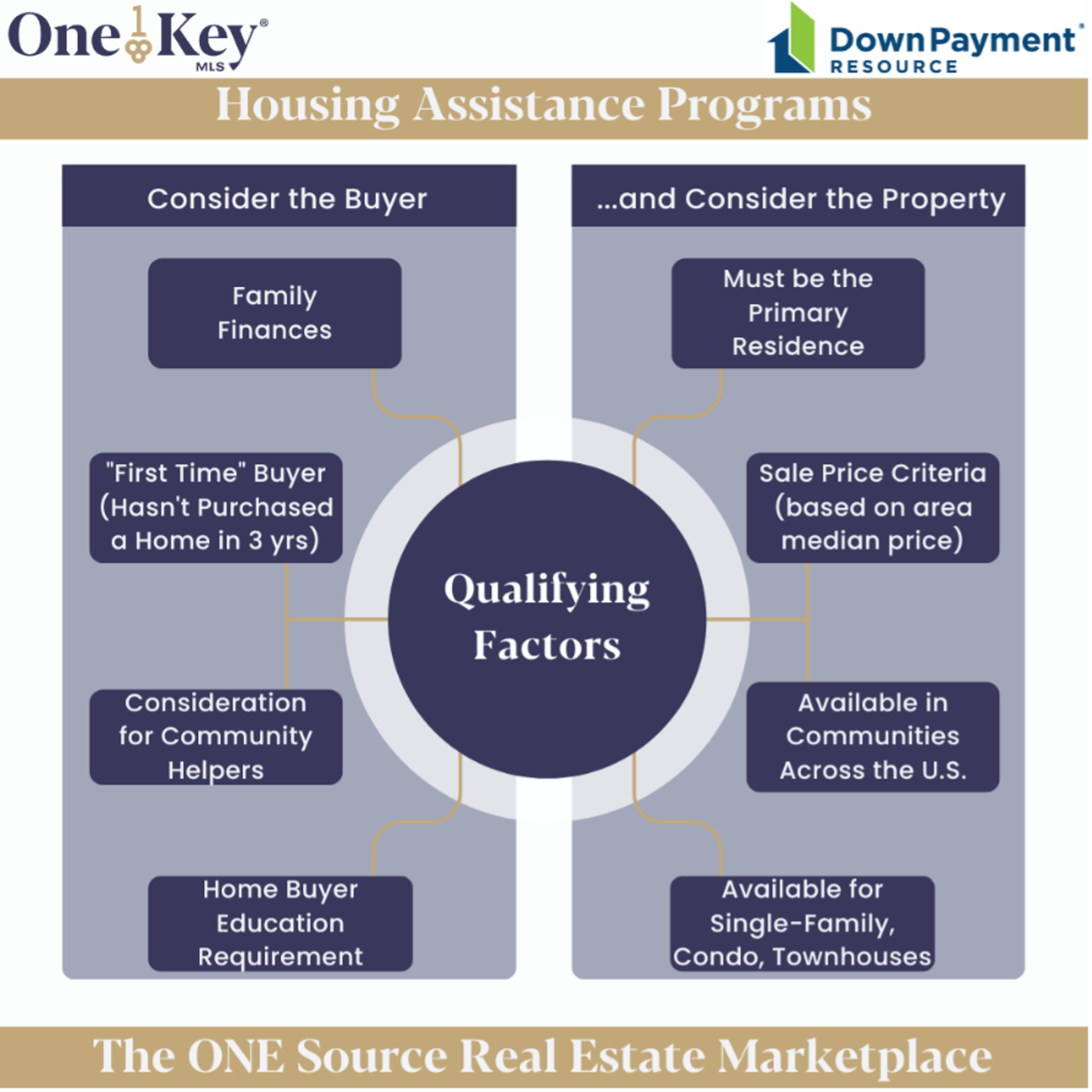

Down payment assistance (DPA) or homebuyer assistance programs come in the form of loans, grants, tax credits, and more. These programs are provided and funded by a wide array of sources. They each have unique eligibility requirements and offer down payment and closing cost assistance to homebuyers in need.

We’re debunking some of the myths about housing affordability, misunderstandings which may make homeownership seem perpetually out of reach.

Myth 1: All DPA Programs are geared toward first-time homebuyers.

"First-time" is a misnomer. Most DPA programs use the US Dept of Housing and Urban Development (HUD)'s definition of "first-time homebuyer" which refers to anyone who has not owned a home in three (3) years. If you've owned before, but are renting now, you may be considered a first-time homebuyer again.

Myth 2: DPA is only available for inexpensive homes.

The eligibility requirements for many DPA programs are wider than you may think. Homes in any neighborhood may be eligible. Eligible listing price limits in high-cost markets can range to over $900,000. Some programs have buyer income eligibility limits of up to 120% of the area's median income. Other programs offer tiered assistance at varying income levels, so higher incomes may yield lower assistance amounts. Household size is almost always a factor as well, where available funding is significantly higher for a family of five as compared to a single person.

Myth 3: You need to be prepared to put 20% down.

According to Down Payment Resource, the 20%-down myth has been widely circulated since the housing crisis of 2008, where access to credit significantly decreased. At that time, even those who were qualified to buy were challenged to put down a large amount at once. In addition to DPA programs, you can also rely on a low down payment loan, to stay competitive without having all the cash up front.

Myth 4: DPA Programs make home financing more difficult.

DPA programs require additional paperwork, similar to the paperwork you'll fill out for a home loan. To avoid any difficulty, choose your lender wisely. Lenders who are qualified to write the loans associated with these programs are known as Participating Lenders and they are specially skilled in incorporating special financing without complicating the transaction or prolonging the close.

Prepare Yourself for the Buying Process

With inventory levels so low, it's tough out there for buyers of all kinds. Don't let saving for a down payment be the main reason you don't start your home search now. Do these four things to get yourself ready for the homebuying process:

- Take a homebuyer education course to understand everything you need to know about the homebuying process for successful homeownership. The earlier, the better!

- Shop around for participating lenders and get pre-approved for a home loan to ensure you'll be able to move quickly once you find the home you want to buy.

- Sign up for listing alerts to be informed of new listings that meet your search criteria.

- Finally, enlist a Realtor® who will be the real estate expert to guide you through every step of the homebuying process.

Find Your Perfect Place

Be the first to know! Sign up for an account and save your favorite properties, then set alerts to be notified when the listing changes. You can also opt-in to receive notifications on new listings or open houses that fit saved search criteria. Sign up for an account and start your home search with OneKey MLS.

Already signed up? Click here to log in to OneKey MLS.

Related Article: Tips to Reach Your Homebuying Goals in 2023 [INFOGRAPHIC]

Related Article:

Understanding Home Price Reports: Keywords You Need to Know