Down Payment Assistance Programs Can Pave the Way to Homeownership

Saving for a down payment can be challenging.

If you’re looking to buy a home, your down payment doesn’t have to be a big hurdle. According to the National Association of REALTORS® (NAR), 38% of first-time homebuyers find saving for a down payment the most challenging step.[1] But the reality is, you probably don’t need as much as you think.

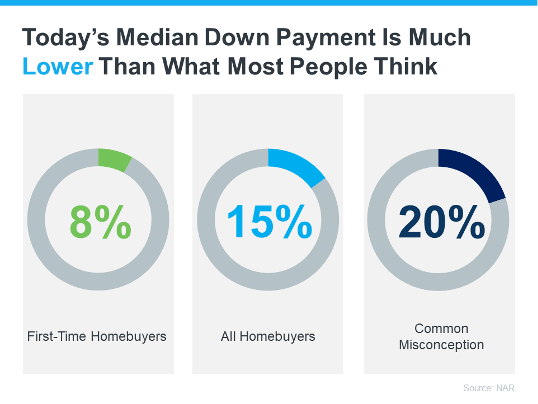

Median down payments may be lower than you think.

Data from NAR[2] shows the median down payment hasn’t been over 20% since 2005. In fact, the median down payment for all homebuyers today is only 15%. And it’s even lower for first-time homebuyers – 8%! Because that’s the median, it implies that you don’t have to put that much down. Some qualified buyers put down even less.

For example, there are certain loan types, like FHA loans, with down payments as low as 3.5%, as well as options like VA loans and USDA loans with no down payment requirements for qualified applicants. There are also many down payment assistance programs that may be able to help you with your down payment.

First-Time and Repeat Buyers are often eligible for down payment assistance.

According to Down Payment Resource, there are thousands of programs available for homebuyers – and 75% of these are down payment assistance programs.[3] First-time buyers are not the only ones eligible for down payment assistance either. No matter where you are in your homebuying journey, there could be an option available for you. Down Payment Resource states:

“You don’t have to be a first-time buyer. Over 39% of all [homeownership] programs are for repeat homebuyers who have owned a home in the last 3 years.”[4]

Your local real estate professional is the best person to begin searching for more information about down payment assistance programs that you may be eligible for. They’ll be able to share more information about available programs, including additional programs for specific professions or communities.

OneKeyMLS.com makes finding down payment assistance easy.

When

searching listings on OneKeyMLS.com, as of December 2023, 74% of all OneKey MLS listings are eligible for at least one type of down payment assistance program. We’ve partnered with Down Payment Resource to tag these listings with a link that says “Down Payment Help” and the Down Payment Resource logo, which looks like a dollar sign and a blue checkmark (see below). By clicking on the link, you’ll be redirected to a webpage that will tell you how many programs the listing is eligible for and ask you to provide basic information to check your eligibility for the available assistance programs related to that listing.

Additional Down Payment Resources

Here are a few down payment assistance programs that are helping many of today’s buyers achieve their dream of homeownership:

- Teacher Next Door is designed to help teachers, first responders, health providers, government employees, active-duty military personnel and veterans reach their down payment goals.[5]

- Fannie Mae provides down payment assistance to eligible first-time homebuyers living in majority-Latino communities.[6]

- Freddie Mac also has options designed specifically for homebuyers with modest credit scores and limited funds for a down payment.[7]

- The 3By30 program lays out actionable strategies to add 3 million new Black homeowners by 2030. These programs offer valuable resources for potential buyers, making it easier for them to secure down payments and realize their dream of homeownership.[8]

- For Native Americans, Down Payment Resource highlights 42 U.S. homebuyer assistance programs across 14 states that ease the path to homeownership by providing support with down payments and other associated costs.[9]

Even if you don’t qualify for these types of programs, there are many other federal, state, and local options available for you. And a real estate professional will be the best one to help you meet your needs as you explore your options.

Final Thought

Achieving the dream of homeownership may be more within reach than you think, especially when you know where to find the right support. Direct your questions to a local real estate expert who can guide you through the search process as you learn what you may be eligible for.

Related Article: Think Twice About Waiting for Home Prices to Come Down

Adapted from Keeping Current Matters.