Why the Economy Won’t Tank the Housing Market

If you’re worried about an upcoming recession, you’re not alone. Over the past couple of years, there’s been a lot of talk about recessions and many people worry about the effect one would have. There’s fear that a recession would cause the unemployment rate to skyrocket, which is something we’ve experienced in the not-too-distant past. Some people even worry that a spike in unemployment would lead to an increase in foreclosures, similar to the circumstances of 15 years ago.

The Forecast Has Shifted

If you find yourself concerned about a potential, upcoming crisis, we have good news for you. According to the latest Economic Forecasting Survey from the Wall Street Journal (WSJ), for the first time in over a year, less than half (48%) of economists believe that a recession is imminent within the next year.[1]

As stated in the WSJ:

“Economists are turning optimistics on the U.S. economy… economists lowered the probability of a recession within the next year, from 54% on average in July to a more optimistic 48%. That is the first time they have put the probability below 50% since the middle of last year.”[2]

Experts Project Optimism

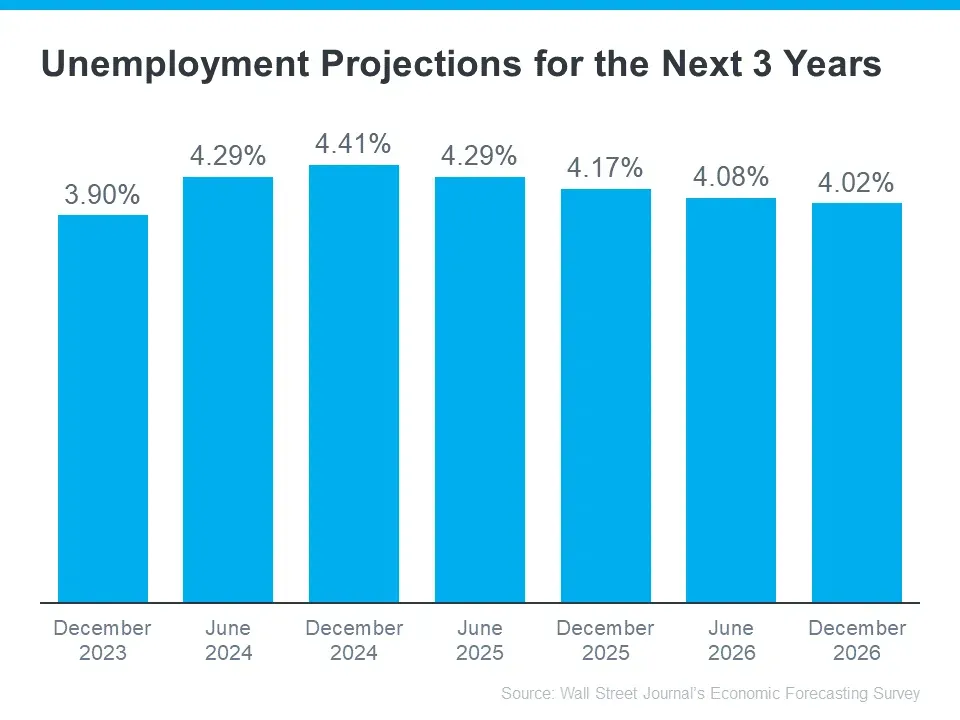

If more than half of the experts no longer expect a recession within the next year, you might naturally think those same experts also don’t expect unemployment to spike – and you’d be right. The graph below uses data from the

Economic Forecasting Survey to show exactly what the economists project for the unemployment rate over the next three years (below):[3]

If these expert projections are correct, more people will lose their jobs in the upcoming years. And job losses are devastating for those people and their loved ones. But, the question remains, will there be enough job loss to cause a wave of foreclosures that will crash the housing market?

Simply stated, no.

Unemployment Now and Then

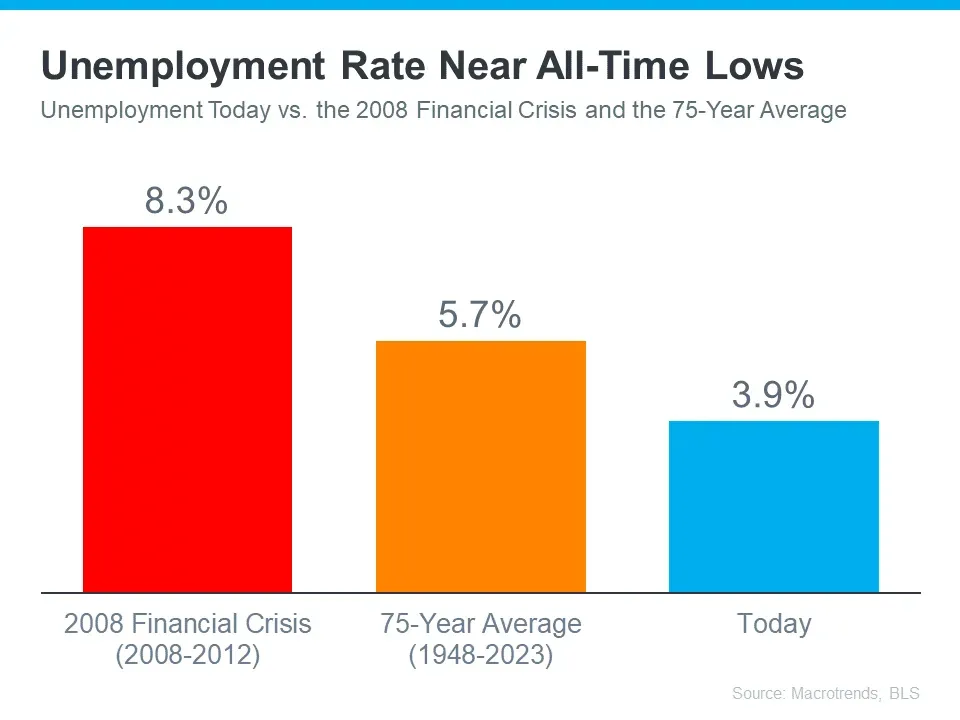

Will the increase in job loss for 2024 cause a housing crash? Based on historical content from

Macrotrends and the

Bureau of Labor Statistics (BLS), the answer is no.[41],[5] The unemployment rate is currently near all-time lows (see below):

As the orange bar in the graph above shows, the average unemployment rate dating back to 1948 is 5.7%. The red bar shows that in the wake of the 2008 financial crisis when the housing market crashed, the average unemployment rate rose to 8.3%. Both of those bars are much higher than the unemployment rate today, shown above in blue.

Moving Forward

Projections show that the unemployment rate is likely to stay beneath the 75-year average. That means we won’t see a wave of foreclosures that would severely impact the housing market.

Most economists no longer expect a recession to occur in the next 12 months and they also don’t expect a dramatic rise in the unemployment rate, the factors we would expect to lead to an increase in foreclosures and another housing market crash.

If you have questions about unemployment and its impact on the housing market, speak with your local real estate expert today and let them put your mind at ease.

[1] The Wall Street Journal Economic Forecasting Survey

[5] Bureau of Labor Statistics

Related Article: Remote Work Opens Possibilities When Searching for Your Dream Home

Adapted from Keeping Current Matters.